For more than 43 years, the Community Foundation of Henderson County has been a trusted center for local giving. We're here to help donors like you make a lasting impact on the causes you care about most. At CFHC, we make year-end giving easy. Our team can help you think strategically about your charitable goals, support the nonprofits you love, and strengthen our community in meaningful ways.

We also work with you to ensure your gifts create the greatest possible impact while maximizing your tax benefits. Even with today's higher standard deduction, there are still smart, tax-wise ways to support your favorite causes. Federal rules taking effect in 2026 under the One Big Beautiful Bill Act will limit charitable deductions for some taxpayers. As a result, making planned gifts in 2025 may offer stronger tax advantages. Because of this, advisors increasingly recommend accelerating charitable contributions this year, either directly to nonprofits or through a Donor Advised Fund or other planned gifts, to benefit from current deduction rules.

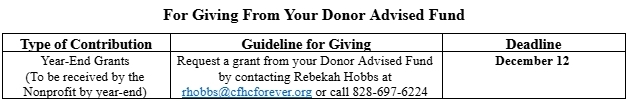

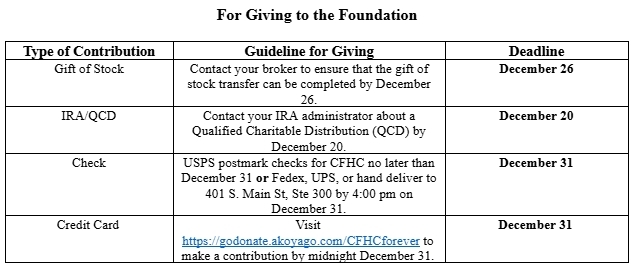

Use the chart below to understand contribution options, giving guidelines, and deadlines for your year-end gifts.