Community Foundation of Henderson County enables individuals and organizations to easily and effectively support the issues they care about – immediately or through their will or estate plan. Donors may contribute a variety of assets to make an immediate gift today, leave a lasting legacy with a planned gift, or both.

Giving Right Now:

- Cash

Cash gifts are an easy and convenient way to support worthy causes through the Community Foundation. Donors may claim a tax deduction.

- Stocks, Bonds, Mutual Funds

Appreciated securities donated to the Community Foundation are deductible. The Community Foundation will liquidate the securities.

Real Estate

The Community Foundation can accept gifts of real property (homes, land, etc.). A donor can transfer the title of a personal residence or other property to the Community Foundation while retaining the right to occupy and enjoy full use of the property for a term of years or the lifetime of one or more individuals. Because gifts of real estate require certain procedural steps, please call the Community Foundation at 828-697-6224 to discuss gifts of this nature in further detail.

Planned Giving Options:

- Life Insurance

Gifts of life insurance policies may be made by naming the Community Foundation as the beneficiary of an existing or new life insurance policy. You receive an immediate tax deduction approximately equal to the cash surrender value of the policy. Any premiums paid thereafter are deductible as a charitable contribution.

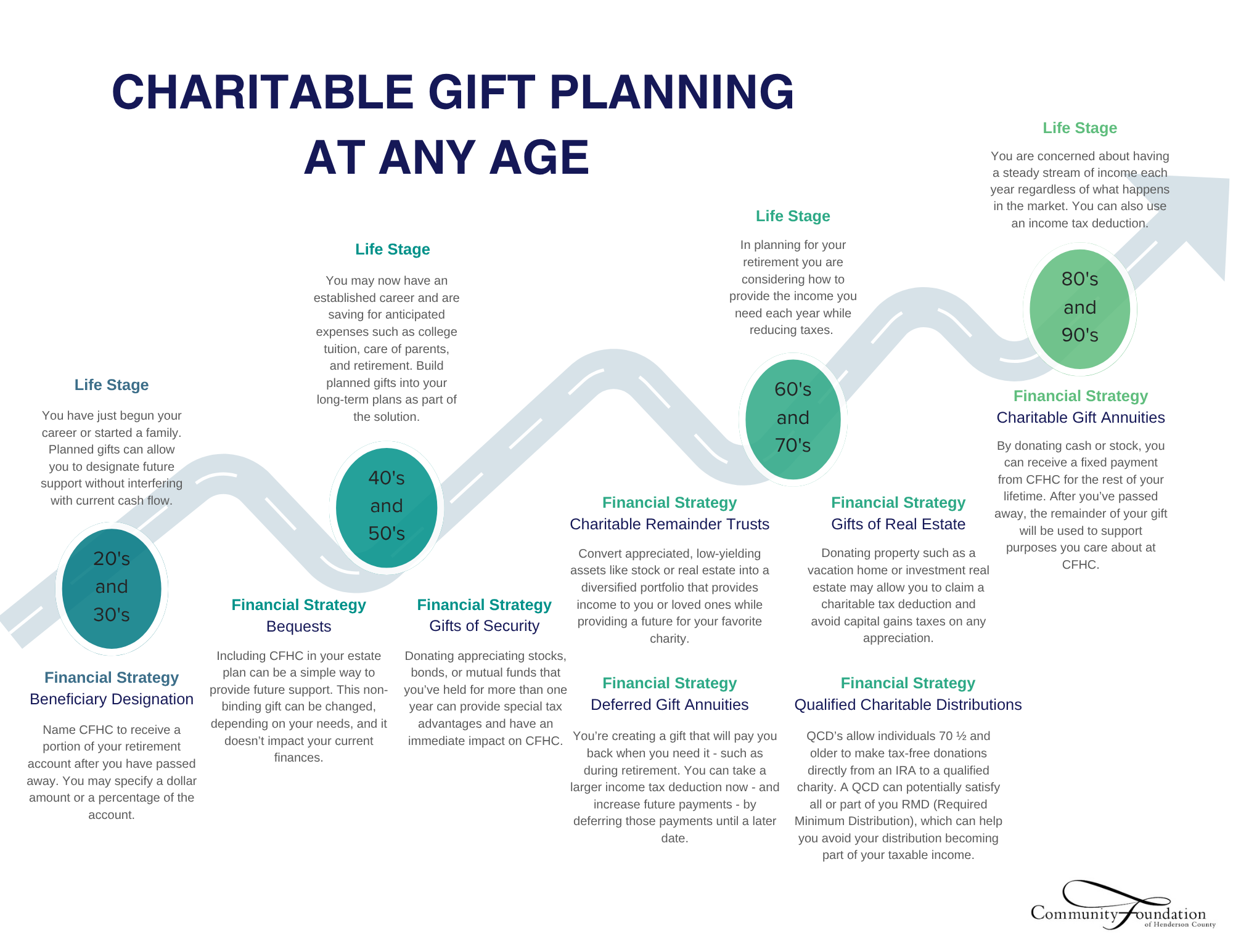

- Bequests

Charitable bequests are one of the easiest ways to give to the Community Foundation because you retain complete control over the assets during your lifetime and support the causes you love later. Bequests can be a specific dollar amount, a percentage of an estate, or the residual that remains after all other bequests are made.

- Charitable Gift Annuities (CGAs)

Charitable Gift Annuities allow a donor to transfer cash or marketable securities to the Foundation in exchange for a current income tax deduction and fixed annual payments for life.

- Charitable Remainder Annuity Trusts (CRATs) & Charitable Remainder Unitrusts (CRUTs)

A charitable remainder trust pays you or another beneficiary regular income payments for life or a specified trust term. Upon the death of the trust’s income beneficiaries, or at the end of the specified years, the remainder of the trust transfers to the Community Foundation to support your charitable giving goals. It’s an opportunity for donors to retain lifetime income, receive a current income tax deduction, and defer the capital gains recognized on the sale of the contributed asset.

- Charitable Lead Annuity Trusts (CLATs) & Charitable Lead Unitrusts (CLUTs)

A charitable lead trust enables you to make charitable gifts now while transferring assets to beneficiaries later. A trust is set up to provide an annual payment to the Community Foundation for your life or a specific number of years. These funds may be added to your fund or any established fund at the Community Foundation. When the trust terminates, the remainder is returned to you or your named beneficiary allowing you to transfer assets to others without incurring estate, gift, and income taxes.

- Individual Retirement Accounts & Retirement Plans

Retirement plan accounts and IRAs are often subject to heavy taxes when left to heirs making them one of the best types of assets to leave to charity. When left to a nonprofit like the Community Foundation, 100 percent of the gift is available to support your charitable interests.